Pawn a Car – Sydney

Pawn a Car for Cash in Sydney

We’re Sydney’s Leading Car Pawn Shop

We can offer immediate cash loans of up to $50,000 against the value of your Car

• Shop 6c/3 Victoria Rd, Parramatta •

Find us on Google Maps📍

PAWN A CAR FOR INSTANT CASH!

✔️ Bad Credit? … No problem!

✔️ No penalties for early settlement

✔️ Pay less if you settle early

✔️ No hidden extras

✔️ Guaranteed maximum loans

✔️ Fast & friendly personal service

✔️ Confidentiality is assured

✔️ A convenient way to borrow

Too easy … simply call Us!

Or apply online and we’ll call you

Or ‘Text’ pics of your car and receive a free loan-value appraisal. Click here to see how >>

Types of cars we pawn:

We pawn most popular makes and models of cars including:

- Sedans

- Coupes

- Sports Cars

- SUV’s AWD

- 4x4s Offroad

- Dual Cabs Utes

- Super Cars

- Station Wagons

- People Movers

We Specialise in Loans against European and Prestige Cars

We also pawn Classic Cars, Muscle Cars and Vintage Cars

Do you need Cash right now?

– hock your car for Cash: $$

E-Pawn is Sydney’s leading car pawn shop. So, if you’re looking to pawn a car, we make the process fast, secure, and hassle-free. We specialise in pawning cars, offering flexible solutions for anyone seeking quick cash while ensuring your car is handled with care.

Pawn just about any make or model of car from $2,000 to $50,000 – possibly more just ask – We offer same-day cash settlement on all loans.

Get a free no obligation quote by calling 1300 855 223

or completing our Online Enquiry Form.

Alternatively, you can ‘SMS’ photos of the car that you would like to get a loan on and we’ll give you a free appraisal of its pawn value. For more information, click here >>

Pawn a car: Important Information

We prefer to pawn late model quality cars in good condition:

- Ideally, cars that are less than 12 years old

– classic cars being the exception; - Registered and roadworthy cars

– at least 3 months rego’ remaining; - Cars with a good service history

– a service book will usually be required; - Cars with no serious mechanical or body imperfections

– all cars a undergo our free mechanical inspection; - In most cases, we will not pawn cars where finance is owing; but,

– we consider every car on a case by case basis.

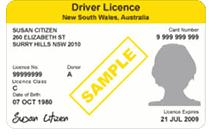

If you want to pawn your car, you will need an acceptable form of identification:

- We will need to sight your Australian Drivers’ Licence

– your name address must match the car’s registered details; - In some circumstances we will accept a NSW Photo ID Card showing:

– Your name;

– Your address;

– Your date of birth; and

– Your signature.

We also need proof of your ownership of the car: i.e.,

- The car’s Registration papers (if applicable); or

- Sales Invoice (in some circumstances); or

- Other acceptable proof of purchase to prove your ownership.

Pawn Your Car Quickly & Hassle-Free

Our Parramatta (Sydney) location makes it easy for you to reach us

-Please note that we work by Appointment Only-

As expert car pawnbrokers, we provide reliable auto pawn services for a wide range of cars, from everyday rides to high-end models. At E-Pawn, we understand the value of your car and ensure every transaction is fair and transparent. So, when it comes to pawning your car, we’re the best choice because we pawn cars quickly and with integrity.

In addition to pawning a car or motorcycle, E-Pawn also offers pawn loans against trailers and other road-registerable vehicles.

Want to know more about our Car Pawn loans … Give us a call today!

Or use on our quick application form below and we’ll contact you with a quote

Quick Application Form

– Frequently Asked Questions About Pawning a Car –

If I pawn a car, how much can I get?

Answer: Pawning a car is determined by its base or wholesale value rather than its full retail value. On average, car pawnbrokers like E-Pawn can offer loans equivalent to about 50% of your car’s wholesale value. For instance, if your car’s wholesale value is $20,000, you could borrow up to $10,000 or more, depending on the car’s condition and your circumstances.

Specialist auto pawn services, such as E-Pawn, typically loan higher amounts than general pawn shops because we have a deeper understanding of vehicle values. Loans range from $2,000 to $50,000, with exceptions for higher-value vehicles. When it comes to pawning your car or motorcycle, E-Pawn is widely regarded as Sydney’s leading car pawn shop.

Does a bad credit rating matter when pawning a car?

No, your credit rating doesn’t matter when you pawn a car with us. Many people worry about this, but as licensed car pawnbrokers, we provide loans based on the value of your car, which acts as collateral. Learn more about our no credit check loans>

Even if you’re unemployed, on a bridging visa, or receiving Centrelink benefits, you can still pawn your car. We also accept cars with club registration, limited registration, or those undergoing restoration.

Pawning your car offers a quick cash loan solution when time is critical. For business purposes, the interest on an auto pawn loan might even be tax deductible.

Note: E-Pawn is not a payday lender.

Can I pawn a car and still drive it?

Australian regulations require that items pawned with licensed pawnbrokers remain in their possession until the loan and interest are fully repaid. When you pawn your car with E-Pawn, we securely store it until you’ve redeemed your pawn loan.

Which is better, pawn or sell my car?

It depends on your situation. If you expect to repay the loan on time, pawning your car can provide short-term financial flexibility. However, if repayment seems unlikely, selling your car might be a better option.

Is it necessary for me to sign over my car?

Not automatically. When you pawn a car with us, the Pawn Ticket agreement outlines terms and conditions, including what happens if you default:

Default: If you don’t redeem the pawned car by the due date, E-Pawn may sell the car to recover the loan amount, interest, and any costs associated with the sale.

Are all pawn shops willing to pawn a car?

No, not all pawn shops are equipped for auto pawn services. Pawning your car requires secure storage and specialised handling. E-Pawn is one of the few Sydney pawn shops capable of securely storing vehicles and providing expert car pawnbroker services..

“Hock a Car” means what?

Hocking a car is the same as pawning a car. The terms are interchangeable, although “hock” is more commonly used in Europe. The terms “pawn” and “hock” are thus synonymous.

Do you only pawn cars in Sydney?

No, we pawn cars from all over Australia. However, the vehicle must generally be brought to our licensed premises in Parramatta, NSW, where E-Pawn operates.

However, in some cases—such as when the car is particularly valuable, temporarily undrivable, or where the owner is incapacitated—we can arrange to have the car securely transported to our premises. Contact us to discuss your specific situation, and we’ll do our best to accommodate your needs..